The American Association for Justice has recently released a report entitled

The Ten Worst Insurance Companies in America.

Insurance Industry Employs "Deny, Delay, Defend" Strategy, Puts Profits Over Policyholders

MONTGOMERY - In recent years, Alabama homeowners have seen sharp increases in their insurance premiums. A new study put out by the American Association for Justice ranks the 10 worst insurance companies in the U.S. for consumers and explains the overall rise in premium costs to an industry-wide strategy of denying claims, delaying payments and defending those positions as long as possible in hopes that weary claimants will settle for less than their claim is worth.

"Nationally, we've seen insurance companies continue to put profits over the best interest of their policyholders," Gibson Vance, president of the Alabama Association for Justice (ALAJ), formerly the Alabama Trial Lawyers Association, said, adding that "in Alabama it's no different."

In Alabama, State Farm (#4 on the 10 Worst Insurance Companies List) is the leading insurer of property and casualty insurance, followed by Allstate, AIG and Farmers (#'s 1, 3 and 7 on the 10 Worst Insurance Companies List). Alabamians pay the ninth-highest average homeowners premiums in the nation, which insurers say is because of hurricane risk, but interestingly only 12 percent of the state is coastal. In addition, property and casualty insurers took in $6.6 billion in premiums from Alabama policyholders in 2006 but only paid out $3.5 billion in losses.

Thousands of court documents, materials uncovered from litigation and discovery, testimony, complaints filed with state insurance departments, SEC and FBI records, and news accounts were reviewed to compile the rankings and statistics of the study. Financial documents also revealed extravagant profits and executive compensation while policyholders' claims were routinely delayed and denied. Over the last 10 years, the property / casualty and life / health insurance industries have each enjoyed annual profits exceeding $30 billion. The insurance industry takes in over $1 trillion in premiums every year. It has $3.8 trillion in assets, more than the GDPs of all but two countries. The CEOs of the top 10 property / casualty firms earned an average of $8.9 million in 2007. The CEOs of the top 10 life / health insurance earned an average of $9.1 million. The median insurance CEO's cash compensation is $1.6 million per year, leading all industries.

"The 10 worst insurance companies that made the list did so because of their shameful treatment of policyholders. As the study shows, Allstate's Your in Good Hands' motto only applies if you don't make a claim," Vance said.

10 Worst Insurance Companies for Consumers

1. Allstate (NYSE: ALL) set the standard for insurance company greed and placing profits over policyholders. Allstate contracted with consulting giant McKinsey & Co. in the mid-1990s to systematically force consumers to accept lowball claims or face its "boxing gloves," an aggressive strategy designed to deny claims at any cost. One Allstate employee reported that supervisors told agents to lie and blame fires on arson, and in turn, were rewarded with portable fridges.

2. Unum (NYSE: UNM) - Unum's actions are even more shameful considering the type of insurance it sells: disability. Unum's behavior was epitomized when it denied the claim of a woman with multiple sclerosis for three years, stating her conditions were "self-reported," contrary to doctors' evaluations. In 2005, Unum agreed to a settlement with insurance commissioners from 48 states over their practices.

3. AIG (NYSE: AIG) - The world's biggest insurer, AIG's slogan was "we know money." AIG, described by commentators as "the new Enron," has engaged in massive corporate fraud and claims abuses. In 2006, the company paid $1.6 billion to settle a host of charges.

4. State Farm - State Farm is notorious for its deny and delay tactics, and like Allstate, hired McKinsey consultants. State Farm's true motives became apparent during Hurricane Katrina; for example, it employed multiple engineering firms until they could deny the claims of the Nguyen family of Mississippi. In April 2007, State Farm agreed to re-evaluate more than 3,000 Hurricane Katrina claims.

5. Conseco (NYSE: CNO) - Conseco sells long-term care policies, typically to the elderly. Amongst its egregious behavior, the insurer "made it so hard to make a claim that people either died or gave up," said a former Conseco-subsidiary agent. Former Conseco executives were fined when they admitted to filing misleading financial statements with regulators.

6. WellPoint (NYSE: WLP) - Health insurer WellPoint has a long history of putting profits ahead of policyholders. For instance, California fined a WellPoint subsidiary in March 2007 after an investigation revealed that the insurer routinely canceled policies of pregnant women and chronically ill patients.

7. Farmers - Swiss-owned Farmers Insurance Group consistently ranks at or near the bottom of homeowner satisfaction surveys, and for good reason. For example, Farmers had an incentive program called "Quest for Gold" that offered pizza parties to its adjusters that met low claims payments goals. Like Allstate, it also hired the McKinsey consultants.

8. UnitedHealth (NYSE: UNH) - The SEC opened an investigation into former UnitedHealth CEO William McGuire for stock backdating, which ultimately led to his ouster in 2006 and returning $620 million in stock gains and retirement compensation. Physicians have also reported that their reimbursements are so low and delayed by the company that patient health is being compromised.

9. Torchmark (NYSE: TMK) - According to Hoover's In-Depth Company Records, Torchmark's very origins were little more than a scam devised to enrich its founder, Frank Samford. Torchmark has preyed on low-income Southern residents and charged minority policyholders more than whites on burial policies.

10. Liberty Mutual - Like Allstate and State Farm, Liberty Mutual hired consulting giant McKinsey to adopt aggressive tactics. Liberty's tactics were highlighted when a New York couple's insurance was "nonrenewed" by Liberty, even though they lived 12 miles from the coast and never experienced weather-related flooding.

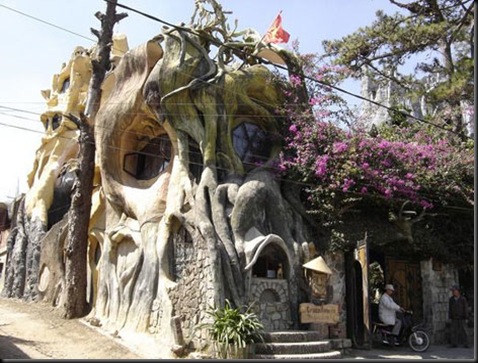

The Mushroom House,also known as the Tree House, is a staple of the Hyde Park section of Cincinnati. It was built by University of Cincinnati professor Terry Brown with the help of his architecture students.

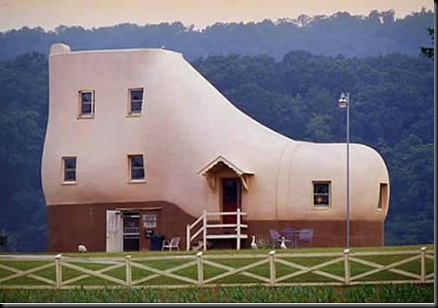

The Mushroom House,also known as the Tree House, is a staple of the Hyde Park section of Cincinnati. It was built by University of Cincinnati professor Terry Brown with the help of his architecture students. American Shoe

American Shoe